No one loves shopping for insurance. It can be confusing, complicated and hard to figure out exactly what you need. On one hand, you want to save money, but on the […]

No one loves shopping for insurance. It can be confusing, complicated and hard to figure out exactly what you need. On one hand, you want to save money, but on the […]

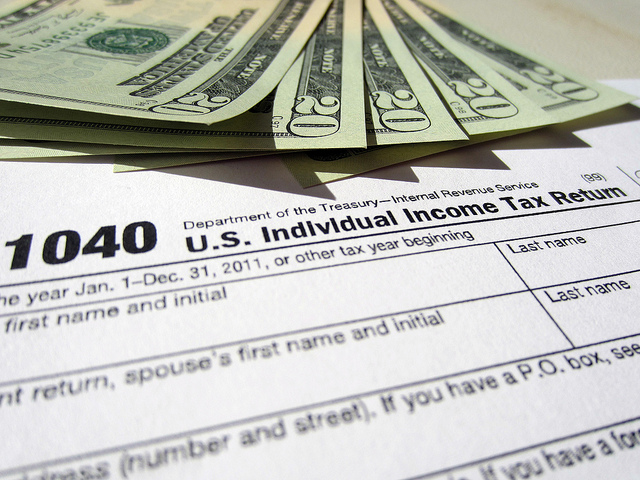

Who doesn’t love getting a nice check back from the government after tax season? Although it may be tempting to head to the mall for a shopping spree or buy […]

It’s a new year and we’re busy writing new policies over here at MassDrive, but we want to make sure that you know what discounts you could be getting so you […]

MassDrive is a whole lot more than just Massachusetts auto insurance. We’re an independent insurance agency with multiple carriers to quote from AND a company that offers you convenience – […]

Many Massachusetts residents may feel as though their car insurance is costing them an arm and a leg, but would you believe that Massachusetts is the least expensive state for […]

Did you know that over 30,000 cars were stolen in Massachusetts last year alone? That’s a lot of stolen cars and even more of an inconvenience for the victims of […]

With 2012 right around the corner, many of us are dreading the credit card bills that can hit us hard after the holiday season. While there may be many resolutions […]

When shopping for auto insurance the ultimate goal is to find a reputable company and the lowest premium. While searching for insurance on the web or over the phone it […]

A recent survey published by Insure.com has revealed the United States most and least expensive states for auto insurance. The study was based on the average auto insurance premium for […]

Toyota drivers involved in recent recalls have worried about how this will affect their auto insurance coverage and premiums. Although a standard auto insurance policy does not exclude vehicles damaged […]