Enrolling in a telematics or usage-based insurance program can help you save on the price you pay for car insurance. Learn how!

Enrolling in a telematics or usage-based insurance program can help you save on the price you pay for car insurance. Learn how!

Distracted driving is dangerous driving. Knowing that it can take just a few small changes in behavior to make the roads safer for everyone on them, we have pulled some things to keep in mind to become a safer driver.

Long road trips can be extremely tiring, we hear that. However, we’re firm believers that the destination is usually worth the journey. So, let’s buckle up and fight your fatigue with these tips.

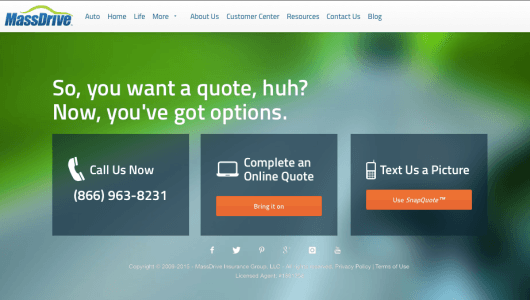

In the competitive insurance industry, here at MassDrive we compete with our commitment to technology and customer experience. After our recent announcement of the debut of our own proprietary online quoting tool, […]

In 2008, the auto insurance market in Massachusetts was deregulated resulting in major changes for both consumers and insurance carriers alike. As more carriers began to write policies in the […]

Memorial Day Weekend kicks off the beginning of summer, and if you’re planning a fun weekend getaway, you’re not alone. There will be millions of drivers on the road this […]

These past few days we have experienced some serious humidity here in Massachusetts. Walking to your car in the blazing sun can be rough enough, and once you get there […]

Renting a home or apartment can be extremely overwhelming and confusing for anyone. A lot of tenants worry about what would happen should there ever be a loss in their building […]

Snow driving is one of the hallmarks of residing in Massachusetts. For some, driving in the snow is the next great adventure, for others, it’s a terrifying experience. Wherever you […]

The holidays! What’s not to love? There’s great music, pretty lights, parties aplenty and, if you’re lucky, a great gift waiting for you under some adorable holiday-themed paper. The holiday season […]