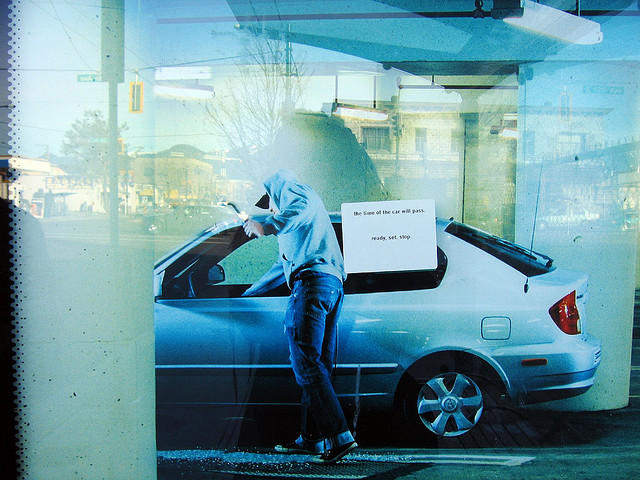

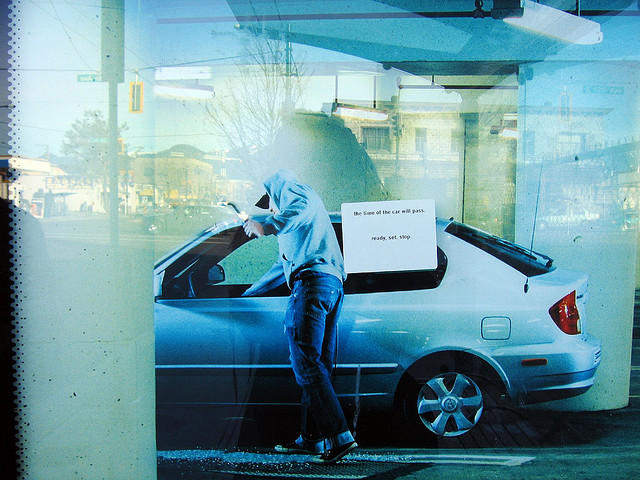

Did you know that over 30,000 cars were stolen in Massachusetts last year alone? That’s a lot of stolen cars and even more of an inconvenience for the victims of […]

Did you know that over 30,000 cars were stolen in Massachusetts last year alone? That’s a lot of stolen cars and even more of an inconvenience for the victims of […]

This October will bring changing leave colors, cooler temperatures, and… deer migration and mating season. As deer begin to frequent more populated areas it’s important to take measures avoiding a […]